Introduction

Ever felt that moment of wallet panic (funds) before you board your flight? That mini-freeze when you wonder, “Do I have enough in the bank for tuition, rent, even health care if I need it?” You’re not alone. Getting clear on how much money you need and why it matters is a crucial step in making your study abroad journey smooth and worry-free. Let’s dive into what top destinations require and how to prepare your funds like a pro.

Why Countries Require Proof of Funds

Governments around the world ask students to show financial proof to:

-

Prevent financial hardship during your studies.

-

Ensure you can manage tuition, rent, essentials—even health care—without illegal work or strain on public funds.

Think of it as a financial safety net—they want to make sure you don’t fall through it.

United Kingdom (Student Visa – Tier 4 / Student Route)

If you’re heading to the UK in 2025, here’s what refresher wheels look like:

-

You’ll need at least £1,483 per month if you’re studying in London, or £1,136 per month outside London, for up to nine months. These thresholds came into effect early January 2025 GOV.UK.

-

You must prove you’ve held these funds for 28 continuous days ending within 31 days of your visa application date—like a financial steady streak GOV.UK.

Sneaky? Maybe. Necessary? Definitely.

United States (F-1 Visa)

Studying stateside? Here’s your financial checklist:

-

Expect to show proof of funds that could range from US$25,000 to $40,000, depending on your school and location. This typically covers tuition plus living expenses for one academic year Prodigy FinanceLeap Scholar.

-

Acceptable documentation includes bank statements, scholarship or loan letters, sponsorship documentation, and details in your I-20 form about how you’ll finance your first year oiss.ucsb.eduWikipediaStudy in the States.

Canada (Study Permit)

Canada is tightening the rules—and fast:

-

Starting September 1, 2025, students must prove living funds of CAD 22,895 per year (for one person, not including tuition). That rises if you bring dependents Government of Canada.

-

You can prove this through paid tuition, a GIC, bank statements, loans, or scholarships Government of Canada.

It’s official: Canada wants to see that bank proof in black and white.

Australia (Subclass 500 Student Visa)

Australia wants clarity and compensation:

-

On top of tuition, expect to show proof of living costs—roughly AUD 24,505 per year Prodigy FinanceWikipedia.

-

Plus, Overseas Student Health Cover (OSHC) is non-negotiable—so plan for your health care upfront The Economic TimesWikipedia.

Comparison Table of Funds Required by Country

| Country | Estimated Funds Required (excluding tuition) | Key Notes |

|---|---|---|

| UK | £1,136–£1,483/month (9 months) | Proof of 28 days required |

| USA (F-1) | US$25,000–$40,000 per year | Includes tuition + living; I-20 documentation |

| Canada | CAD 22,895/year | Accepts GIC, bank statements, loans |

| Australia | AUD 24,505/year + OSHC | Health cover mandatory |

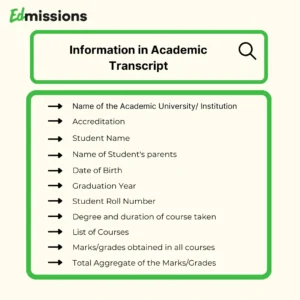

How to Demonstrate Proof of Funds

-

Bank statements must show your name, institution’s stamp, recent 3–6 months’ activity, and sufficient balance oiss.ucsb.edu.

-

Loans, scholarships, sponsorships should come with formal, signed letters showing awarded amounts.

-

Always check your university’s requirements; they might have a special form or phrasing they prefer.

Role of Health Care in Funding Requirements

Planning for health care is more than just a top-up—it’s a must-have in your budget:

-

In the USA, medical costs can skyrocket if you’re uninsured—so plan ahead or buy health insurance.

-

In Australia, OSHC is required; don’t assume it’s included. Add it to your visa cost list.

-

In countries like the UK, NHS costs may apply; even then, health funding expectations are baked into financial thresholds.

Tips to Avoid Financial Surprises Abroad

-

Use online cost calculators to estimate rent, food, and health care in your city.

-

Keep extra savings—10–15% buffer—for emergencies or exchange rate glitches.

-

Prepare your documents early—last-minute bank transfers can mess up the 28-day requirement.

Recent & Upcoming Changes to Watch (2025–2026)

-

UK tightened their living fund requirements as of January 2, 2025 GOV.UK.

-

Canada’s updated proof-of-funds requirements kick in September 1, 2025 The Times of India.

Migration policies are shifting—stay informed and ahead of the curve!

Conclusion

So, what’s the bottom line? Before stepping onto that plane in 2025, make sure your bank balance is not just “okay,” but compliant with your destination’s rules—especially for tuition, living expenses, and health care coverage. Whether it’s showing nine months of savings in the UK, or CAD 22,895 in Canada, having clarity now saves migration headaches later. Bank wisely, document thoroughly, and you’ll arrive ready to embrace your study journey—without financial surprises.

FAQs

Q1: What counts as proof of funds for a student visa?

Usually recent bank statements, loan or scholarship letters, GICs (Canada), or sponsorship documentation—all must be verifiable and meet the country’s minimum thresholds.

Q2: Do health care costs count toward required living funds?

Yes. In Australia it’s mandatory (OSHC), and in the USA, private health insurance is often essential. Even when not explicit, governments expect you to budget for health care.

Q3: Can I use a scholarship to meet proof-of-funds requirements?

Absolutely—if the scholarship is confirmed with documents showing amount and duration.

Q4: What happens if my funds drop during the 28-day proof period?

That could jeopardize your application. Many visa authorities require the amount to be consistently present for the full 28 days.

Q5: Are these financial requirements changing anytime soon?

Yes—keep an eye out: the UK updated in early 2025 and Canada will change again 1 September 2025. Always rely on official immigration sites for the latest.